The AI Bubble isn’t as Bubbly as It Looks

Nvidia’s market cap this week surpassed Microsoft’s to become the world’s most-valuable company. But it may be an outlier among AI firms.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

AI isn’t a bubble, it’s a soufflé, and it’s already started to de-puff.

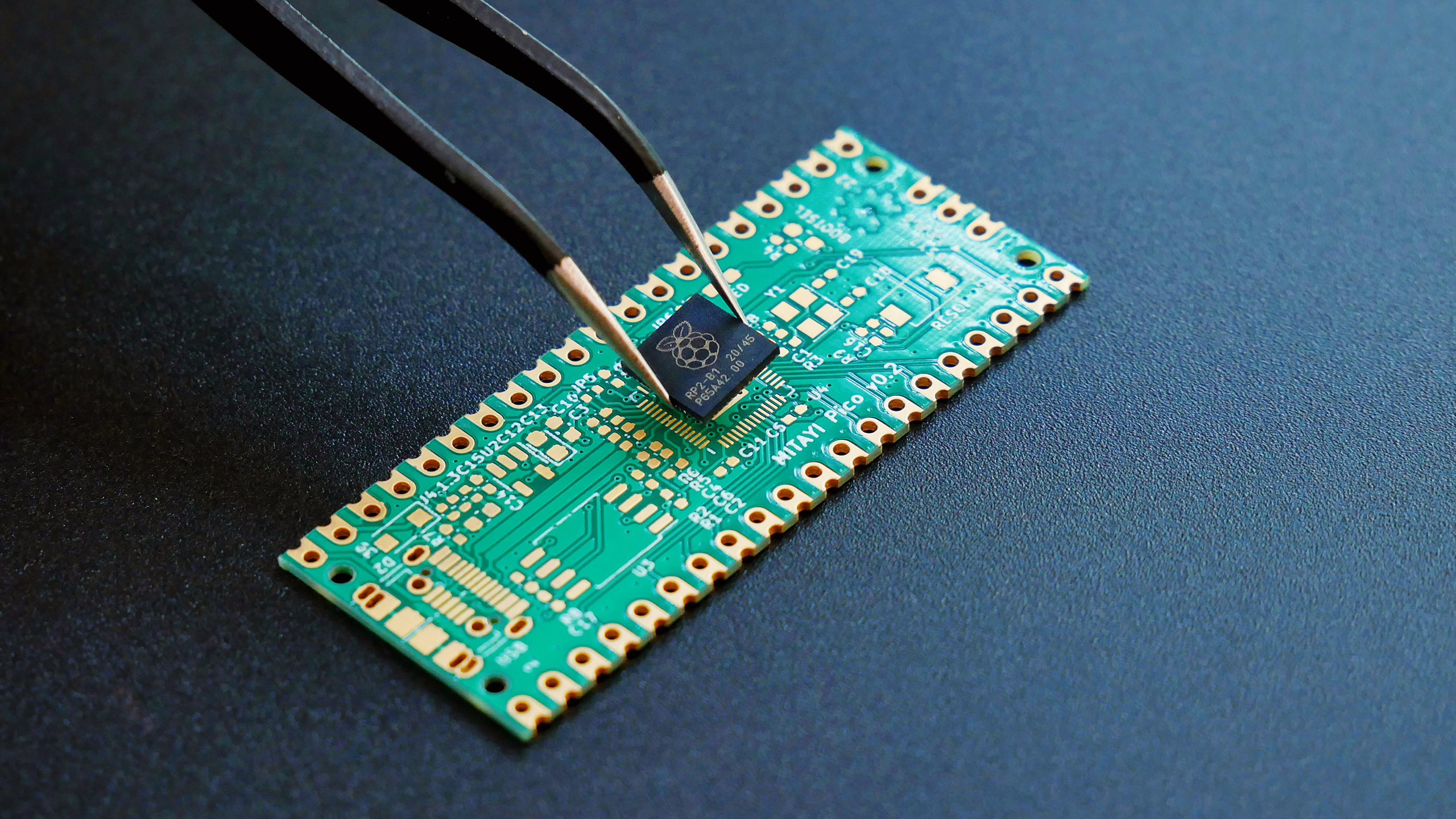

The value of some AI-linked firms has indeed gone stratospheric — the biggest being chipmaker Nvidia, whose market cap this week surpassed Microsoft’s to take the crown of world’s most-valuable company. But Nvidia is an outlier, not just among chipmakers but AI hypebeasts in general, according to a new Financial Times analysis published Wednesday.

To Nvidia and Beyond

Our regular readers will be pretty familiar with Nvidia’s rise, but as a quick recap: Over the past 10 years, Nvidia’s stock has gone up by around 28,000%. Over the same time period, Microsoft’s stock went up a paltry 825%. But Nvidia’s rise isn’t because it builds verbose chatbots or uncanny image-generators; its value has skyrocketed because it underpins the physical supply chain behind generative AI products like OpenAI’s Chat-GPT, so much so that the G7 may be preparing to step in. It’s also a fairly simple case of good numbers, as Nvidia’s revenue has seen consistent quarter-on-quarter revenue growth. In its most recent earnings report, Nvidia said revenue vaulted 18% compared to the previous quarter, and 262% year-over-year.

But Nvidia and its hardware do not reflect the reality for broader, more software-anchored AI companies, most of which remain technologies in search of a business model. The FT examined the stocks belonging to companies in Citi’s “AI Winners Basket” and found that more than 50% of those firms have lost value this year — a significant deflation given 75% of them rose in value in 2023. It also found AI investment funds have had a much more ambivalent 2024 than the year before, suggesting a broad downturn:

- It’s possible that we’re at the stage of the generative AI hype cycle when investors are more discerning about which companies with an “.AI” suffix they give money to.

- Companies are also beating the AI drum a little less vigorously. Bloomberg reported in May that references to AI on company earnings calls dropped over 56% from Q1 of this year to Q2.

“When I ask our analysts outside the tech sector if they have significantly changed their cost or revenue projections as a result of AI, there’s a lot of shrugging of shoulders, which says to me that this is evolution, not revolution,” UBS chief strategist Bhanu Baweja told Bloomberg at the time.

Going Soft: Nvidia also has a soft side. This week it agreed to buy Shoreline, a startup that makes software for automatically tracking down and troubleshooting problems in computer systems. A source told Bloomberg the deal pegs Shoreline’s valuation at $100 million, although neither company confirmed it. Nvidia is also an investor in Perplexity, which wants to make a Google-killing AI search engine — but on Wednesday, Wired published a piece accusing Perplexity of scraping bits of the web (including Wired’s own journalism) it said it wouldn’t. The magazine also said Perplexity yielded seriously false answers to questions — like wrongly summarizing a Wired article to say it accused a named police officer of committing a crime. We don’t need our AI to fake it until it makes it.