JPMorgan Chase Brings Quantum to Wall Street

JPMorgan Chase may be looking past the current AI craze for optimization, setting it’s sights on quantum computing.

Sign up to uncover the latest in emerging technology.

JPMorgan Chase may want to get a bit more scientific with how it picks stocks.

The financial institution is seeking to patent “quantum computing-assisted portfolio selection.” Essentially, JPMorgan’s system instructs a quantum computer to come up with the most “optimal portfolio selection” for a user based on their parameters for risk and reward.

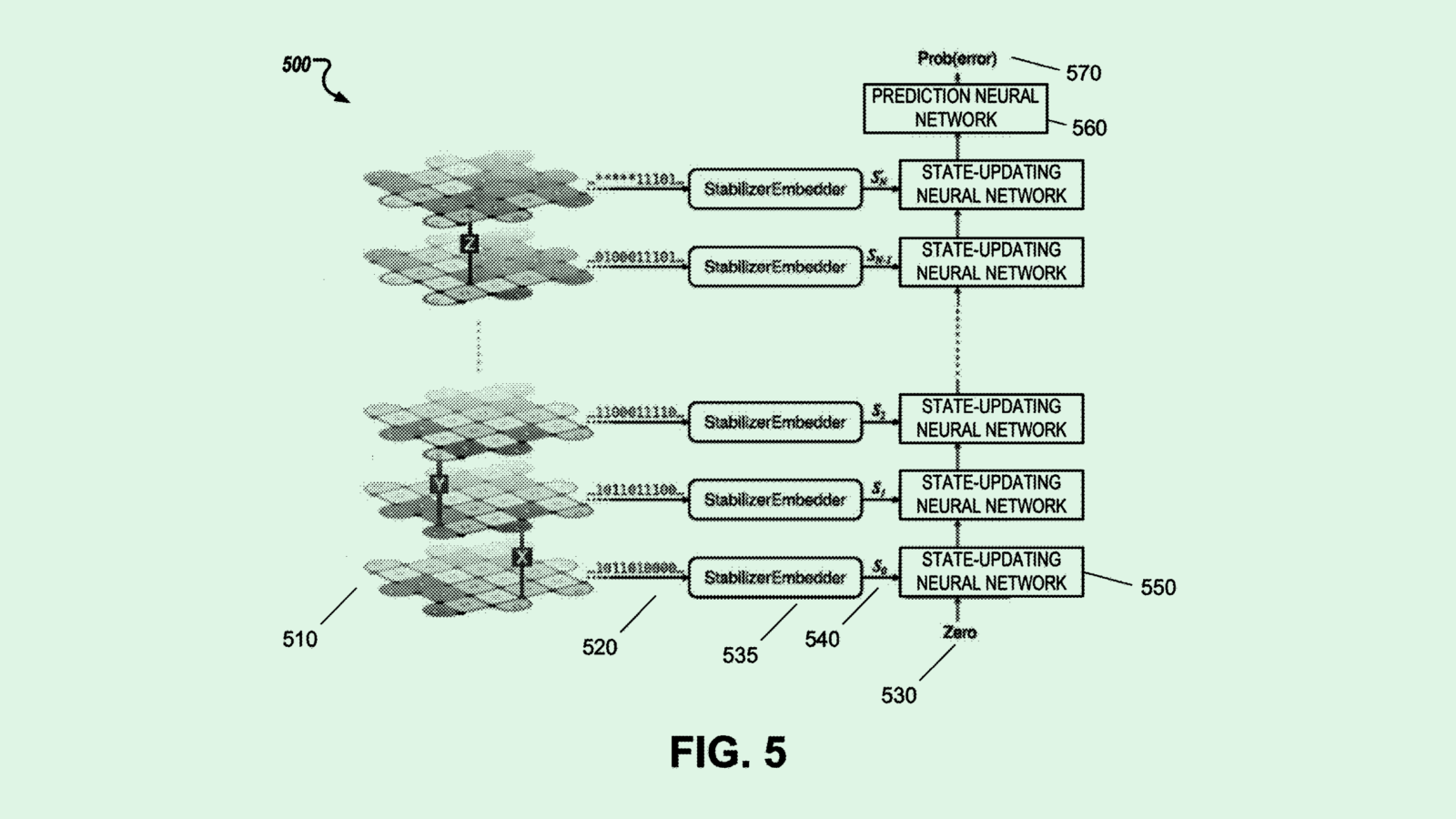

First, an investor gives this system asset selection parameters for their portfolio, such as the returns they expect or the volatility they’re comfortable with. The classical (aka normal) computing system then picks assets based on these initial parameters, and sets upper and lower risk boundaries, or the highest and lowest limits that any given asset in a portfolio can go.

JPMorgan’s system feeds these asset selections to a quantum computer to optimize the portfolio. Meanwhile, a classical computer finds the “objective functional value,” or how well the portfolio fits in with the investor’s desires, of the current selection of assets. That objective functional value is then used to adjust the higher risk limit of the portfolio. Finally, the quantum computer runs another calculation to refine its asset selection again, using that new higher risk limit.

After going through these calculations, the computer then spits out the best possible stock portfolio selection for the user.

Though this patent makes it sound simple, quantum computing is far from it. For reference: Quantum computing relies on the properties of quantum mechanics to perform incredibly complex and difficult calculations at a much faster rate than the average computer. The tech is still in its early days and faces a number of obstacles to becoming an everyday reality.

As it stands, AI currently has the stage as the next big technological advancement to flip the financial services industry on its head. Plenty of financial institutions are rushing to embed the tech into their workflow: Goldman has filed several patents for AI-based investing tools, and Morgan Stanley just announced an internal AI assistant relying on OpenAI’s tech.

JPMorgan itself has sought out plenty of patents for AI use cases in its operation, including a matchmaking tool for investors and startups, a research automation tool, and an internal recruiting tool. Plus, the company filed a trademark application in May for IndexGPT, a chatbot investment advisor.

It’s no wonder why these institutions are clambering for AI, as the tech has the potential to make better and more precise decisions and predictions faster than ever before. But quantum computing may promise even more.

The once-theoretical technology has the potential to take on incredibly complex calculations with ease, and accelerate the capabilities of AI to make sense of large quantities of data, according to Deloitte. The firm noted in a July report that it expects spending on quantum computing products to reach $19 billion by 2032, up from $80 million last year. By going after this patent, JPMorgan may be attempting to seize some power within the quantum computing space before the tech makes a real entrance on the trading floor.

That said, JPMorgan isn’t the only company keeping a sharp eye on quantum computing: In May, HSBC announced a partnership with quantum computing firm Quantinuum, aiming to explore real-world business use cases for the tech.