Sign up to uncover the latest in emerging technology.

Plus: A peek at eBay’s NFT machine; Booz Allen’s AI watermark;

Happy Monday and welcome to Patent Drop!

Today, we’ll dive into a patent application from Block for collateral crypto, Booz Allen Hamilton’s tech to put a name on AI models, filings from eBay that lay out how NFTs and vintage watches could go hand in hand…. or hand on wrist.

But first, let’s hear from our sponsor, AcreTrader 一 the team that helps you get farmland assets into your portfolio. Their platform enables accredited investors to invest in the real, tangible asset of farmland, which has a lengthy track record of positive returns. A corn farm in Iowa or a citrus ranch in California can help you diversify your portfolio. Consider adding farmland to your portfolio with AcreTrader. Learn more here.*

Let’s check it out.

#1. Block’s crypto collateral plan

Block may be fattening its crypto piggy bank.

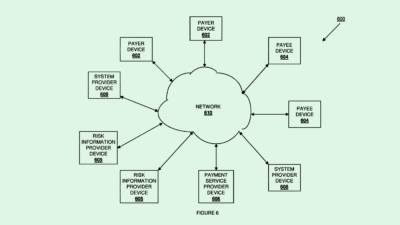

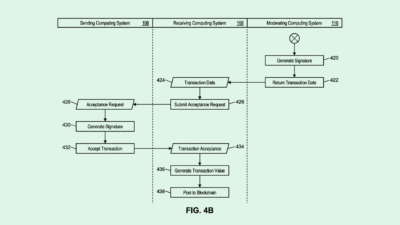

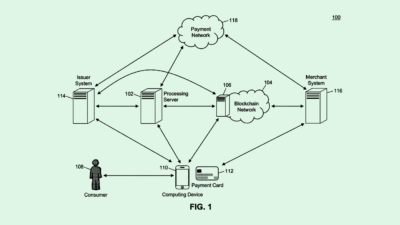

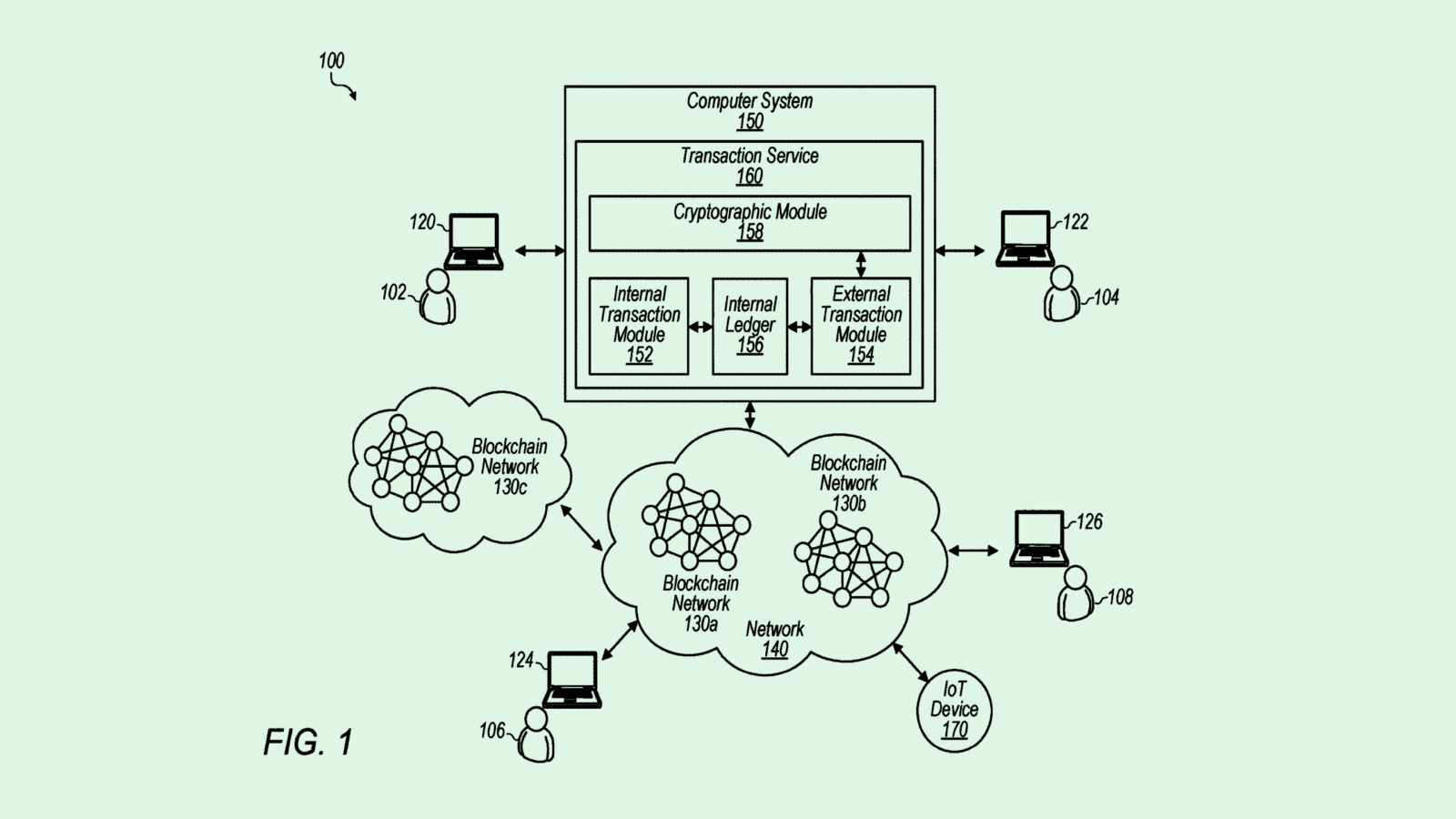

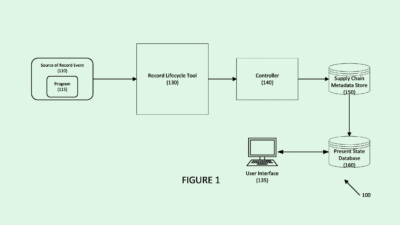

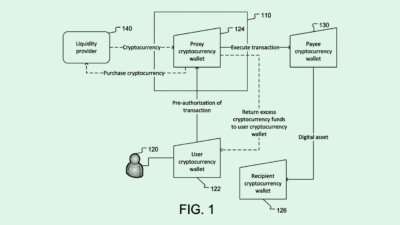

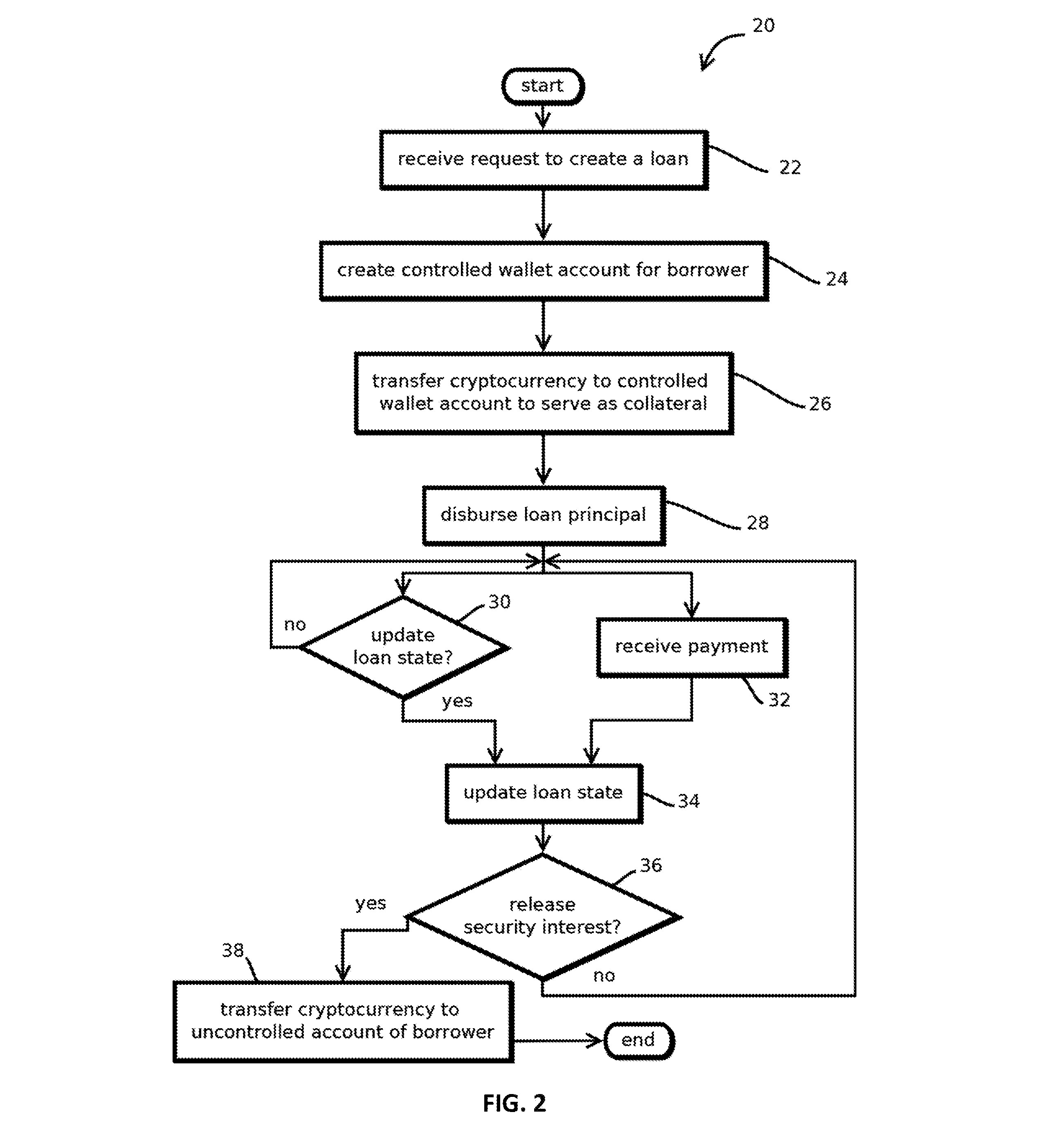

The parent company of Square is seeking to patent tech for crypto asset “collateral management.” To break it down: Block’s system allows users to put up blockchain assets, like cryptocurrency, as collateral for a loan and uses a distributed ledger to track things like loan amount, interest rate, payment due dates, payment histories and accrued interest.

Block’s proprietary tech attempts to solve two of the biggest risk factors that deter loan providers from lending against crypto: The erratic fluctuations in value and the “low barriers to transaction” (a.k.a., how easy it is to transfer your assets to someone else).

To prevent a borrower from transferring assets held as collateral to someone else, a new account is created “over which the borrower has diminished control.” Block’s tech also monitors the value of the crypto asset being held as collateral and then adjusts it if it passes a certain threshold. For example, it will also automatically add cryptocurrency from the borrower to a collateral account if the “loan-to-value ratio” drops too low.

“Holders of virtual assets … often find it difficult to borrow against those assets, using them as collateral,” Block said in its filing. “Often asset-owners wish to retain ownership of the virtual cryptographic assets to avoid tax consequences of a sale or to maintain exposure to price changes in the assets and participate in appreciation.”

While Block referenced crypto throughout the application, the company noted that this tech could be applied to NFTs and other virtual assets as well.

In the aftermath of last year’s crypto crash, crypto lending firms were hit particularly hard. Major crypto lenders like Celsius, Genesis and BlockFi all filed for bankruptcy, leaving their users in limbo and owing creditors tens of billions of dollars.

But after its name change from Square to Block, co-founder and CEO Jack Dorsey staked the company’s future on crypto, telling investors at a presentation last May that the currency is “open standard for global money transmission,” allowing its “entire business to move faster globally.”

Despite the volatility in cryptocurrency over the past year, Block seems to want to lead the charge in the tech’s development. Since that presentation, Block has been hammering away at a number of fanciful crypto-related projects, including a Bitcoin mining development kit and a physical crypto wallet that looks like a literal rock.

This patent filing marks the latest of Block’s crypto shift, and it could manifest in a few different ways. It could be integrated into the existing infrastructure, like Block subsidiary Cash App (which already offers crypto trading), packaged as a product to be sold to other companies, or created into a whole new platform entirely.

One potential problem is that several other companies offer services eerily similar to that of Block’s patent, Stuart Sim, head of marketing at blockchain real estate company Fabrica, told me. On the NFT side, there are platforms like NFTfi, Arcade and BendDAO, and on the crypto side, lenders like Aave, Compound and Nexo are leaders.

“This looks like services that already exist, from platforms that are doing hundreds of millions of dollars in NFT loans,” said Sim. If granted, Block’s patent may put these businesses in a precarious spot.

#2. EBay’s nonfungible dreams

While we’re on the topic of blockchain, a few of eBay’s recent patent filings show how it wants to be a one-stop shop for both luxury sneakers and NFTs.

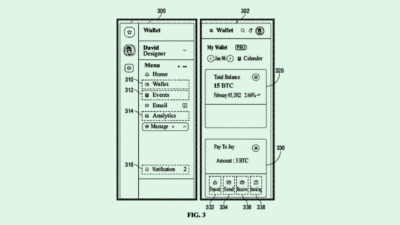

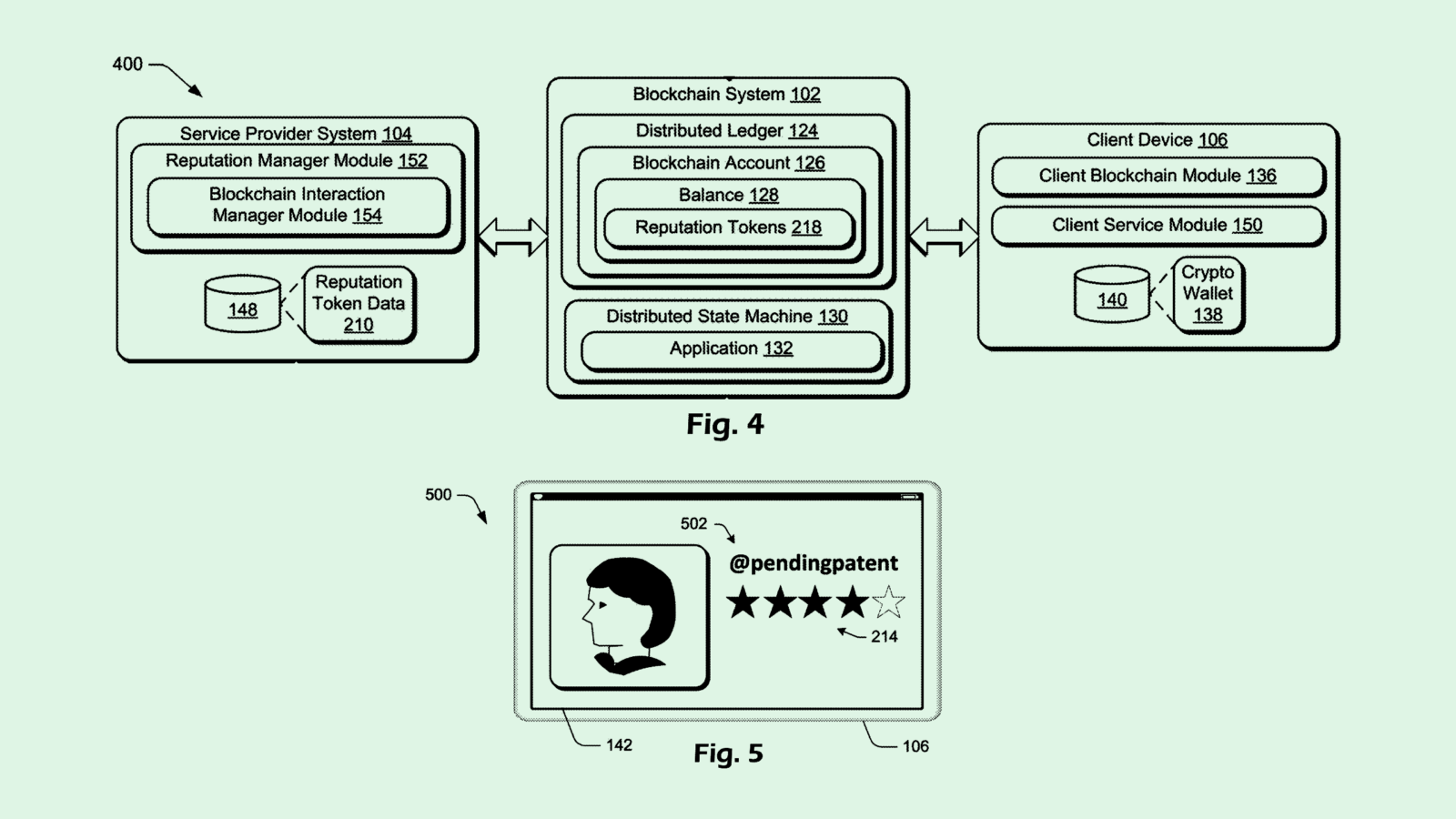

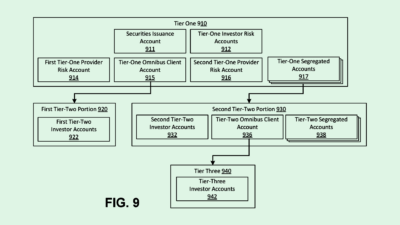

First up, eBay filed a patent application for a system for “fingerprinting physical items to mint NFTs.” Basically, this tech uses several photos of a product to create and mind a “digital twin NFT,” as well as to authenticate the item. Once it’s authenticated, a user can create a combined listing for both the item and the NFT.

According to eBay, blockchain can be a helpful tool in selling physical products, particularly luxury goods, due to its “ability to uniquely identify an asset from other assets and … the functionality to record every transaction involving the asset.”

The company also wants to patent tech for “digital content control” based on NFTs. This essentially allows eBay sellers to offer NFT holders exclusive content, like digital artwork, videos, or even redeemable discounts for other products, by “twinning” the NFT, or simply creating a corresponding digital item (similar to its plan for physical fingerprinting).

Adding this functionality, eBay, said, “encourages retention of the NFT and thus functionality made available via the NFT.”

It’s well-known that eBay is all in on blockchain. The company began allowing NFT transactions in May of 2021, and acquired NFT marketplace KnownOrigin last year for an undisclosed price, calling the purchase “an important step in eBay’s tech-led reimagination.”

“EBay is the first stop for people across the globe who are searching for that perfect, hard-to-find, or unique addition to their collection and, with this acquisition, we will remain a leading site as our community is increasingly adding digital collectibles,” Jamie Iannone, CEO of eBay, said at the time.

It’s been working on integrating blockchain in other ways, including filing a patent for tech that secures shipping interactions using blockchain, flirting with adding a way to accept crypto payments on its platform and hiring for several Web 3.0-related jobs earlier this year.

Integrating authentication of physical products with its NFT operability is a natural fit for the company. A big part of eBay’s business is reselling rare, vintage and luxury items, with the company offering authentication services for higher-end products. Adding a way to record these transactions on blockchain could minimize fraud while giving sellers another potential revenue stream with NFT sales.

And while NFTs have seen better days, with prices slumping and tech giants companies like Meta casting blockchain aside, there are still signs of life in the sector, with trading volumes hitting a 7-month high in February. If the industry rebounds to pre-crypto crash levels, eBay may be prepping to ride the wave.

SPONSORED BY ACRETRADER

Are You Investing In Real Assets?

Did You Know You Can Invest in Wine Grapes?

Wine grapes. Pistachios. Almonds. Avocados. Soybeans. Cotton. Corn. These are just a few of the many crops grown on farmland investment opportunities offered by AcreTrader, the premier platform for investors to earn potential income on farmland.

Natural Diversifier : Farmland is a long-term alternative asset with impressive historical performance according to *NCREIF, low volatility, and low correlation to equities.

Double Duty: Your money works overtime when you invest in farmland, with return potential from both annual rent and land appreciation.

You don’t need to be a fifth-generation farmer to reap the benefits of owning a farm. Explore

an investment in farmland today with AcreTrader.*

#3. Sign on the dotted line bits and parameters

Booz Allen Hamilton wants to help you mark your AI territory.

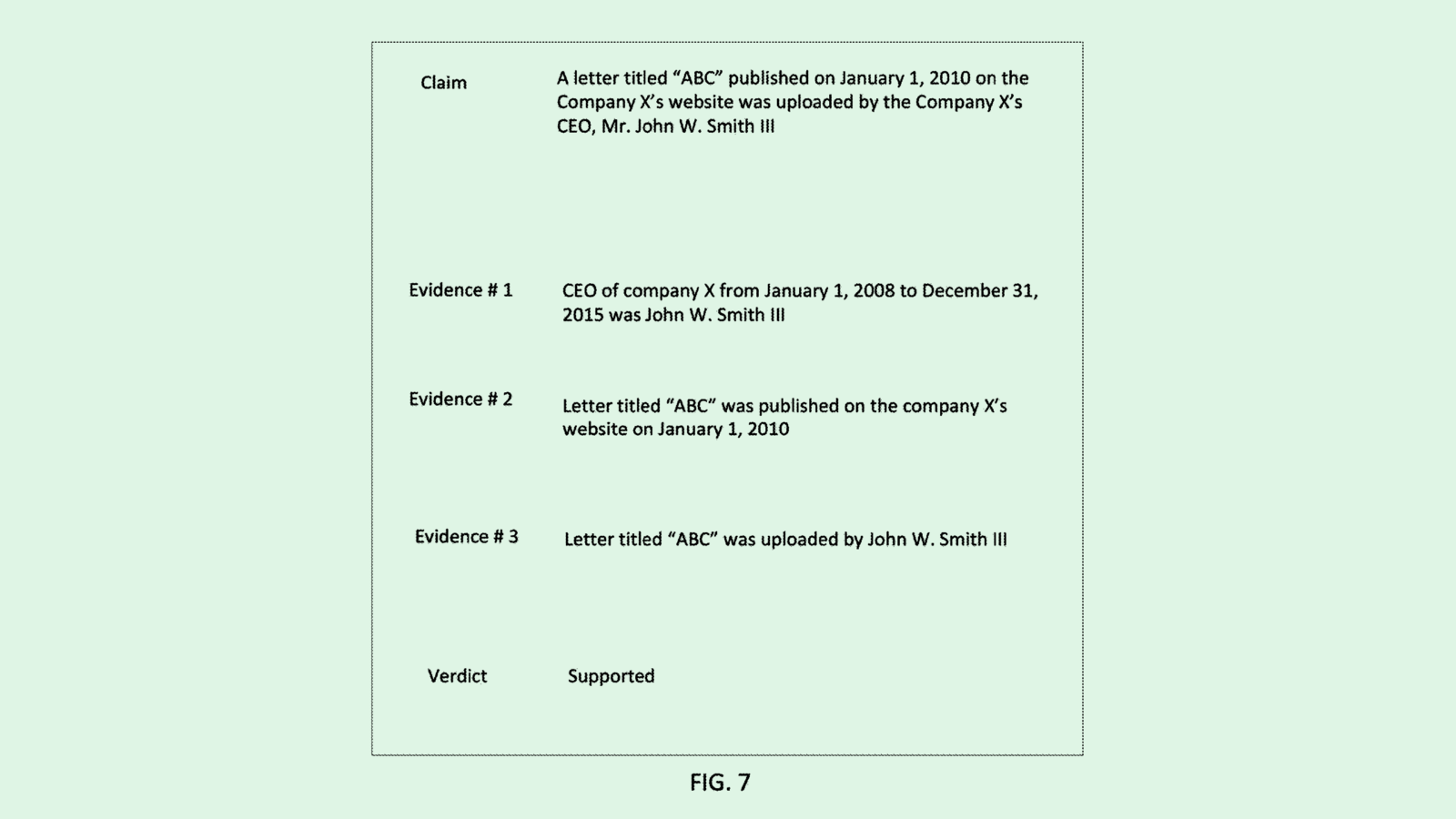

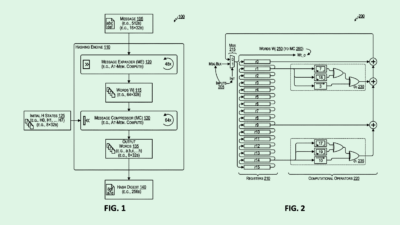

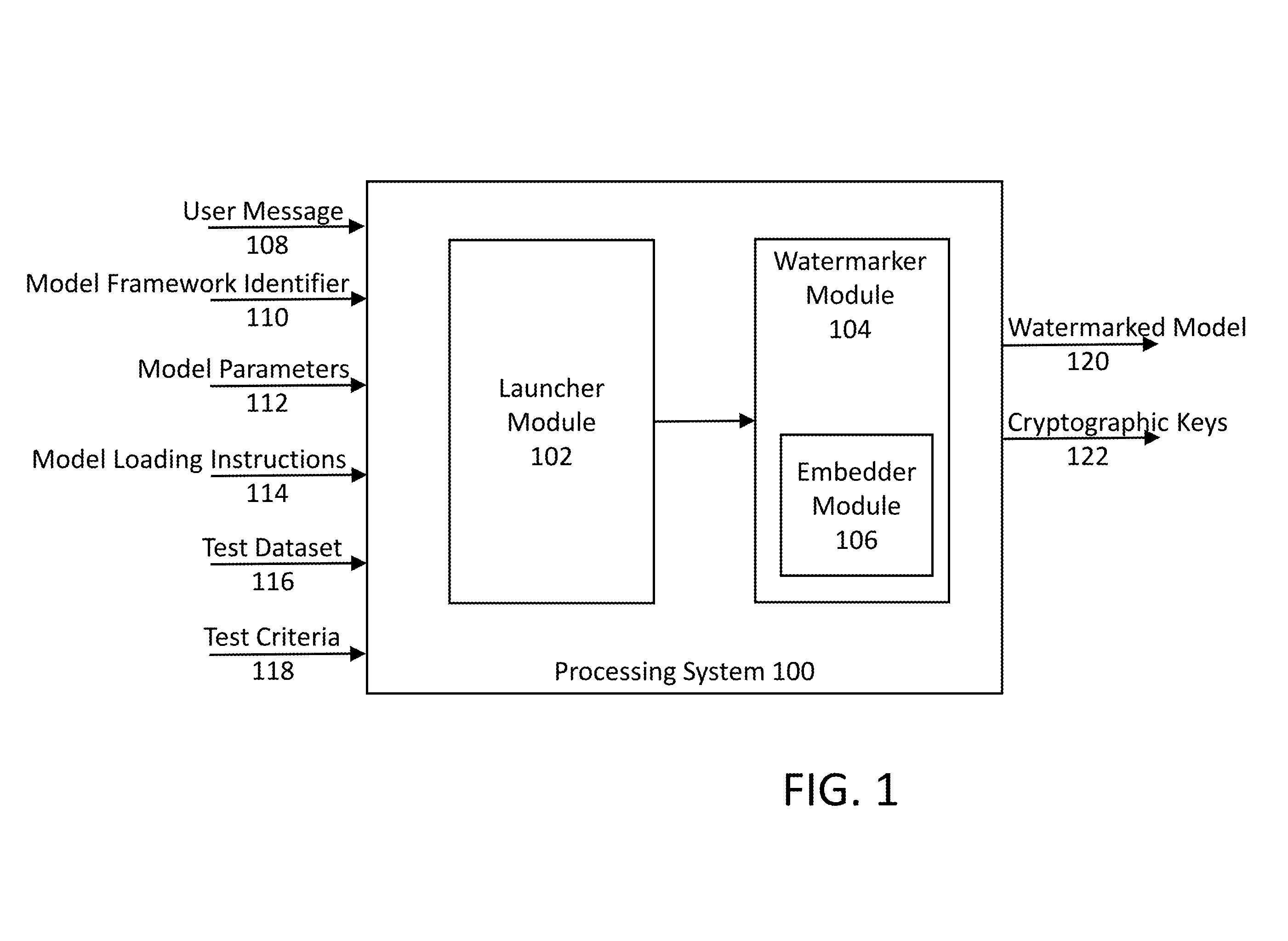

The consulting firm seeks to patent a system for “watermarking a machine learning model” as belonging to a specific owner. This tech works by embedding a message, translated into binary code, into the bits (a.k.a. numbers in the math equation) of the machine learning model. However, to do so without greatly impacting the outcomes, this system chooses bits in the parameters of the model that are “less impactful on model performance than others.”

So how does this system do this without messing up the whole model? Think of it like this: You have a bank account with $900,000.50. If something changes that number to $900,000.49, it doesn’t noticeably impact the funds you have. But if another digit is changed, say to $100,000.50, you would lose a noticeable amount of money.

The same concept applies to this method of watermarking. If a model is thousands upon thousands of parameters long, you can make changes to bits in parameters that show up in the later parts of it, embedding a secret binary code that marks the model as yours. Booz Allen noted that “there is no effective method to digitally mark a machine learning model to identify its source or owner.”

“A brute force method (e.g., trial and error) can be used to mark a machine learning model by changing the parameters of one or more nodes,” the company noted. “However, such a process is not only inefficient but can also lead to drastic changes and a degradation in model performance.”

Machine learning models can take massive amounts of time and effort to create. As this kind of tech becomes more prevalent in the public eye, developers will want the ability to claim their work as their own, said Micah Drayton, partner and chair of the technology practice group at Caldwell Intellectual Property Law.

“Machine learning models are inherently quite … easy to copy,” said Drayton. “People are going to want to be able to have some control over what models they’re using and where models come from.”

While some companies can put machine learning models behind firewalls, Booz Allen’s tech adds an extra layer of protection from things like internal leaks. It can also help in the case of product liability, Drayton said. For instance, if your company purchased an AI model that runs machinery in your factory, and someone is hurt by said machinery, they can trace back who is responsible through a watermark.

Plus, because you can’t directly copyright or patent a machine learning model, adding a watermark is one of the only ways developers can protect their work, giving them the ability to “prove when someone’s taken it, and make sure that there’s a contract in place that shows they’re in breach if they did take it,” said Drayton.

If you’re wondering why a consulting firm like Booz Allen would go out of its way to try to patent this, think about the clientele that the company is commonly servicing: government agencies, Fortune 500 tech companies, defense and security organizations, and more. Many of these clients likely hold privacy of IP as a very high priority, and would pay the firm a pretty penny for the tech to properly protect it.

Extra Drops

We’ve got a few more up our sleeve.

Ford wants to keep its drivers safe. The company wants to patent tech to “detect stalking of an individual” traveling in a connected vehicle to track the “travel pattern” of another vehicle and warn the driver whether they may be getting stalked.

Google wants your smart speaker to hear you out. The company seeks to patent training for “long-form speech recognition” technology which can decode what you’re saying when you’re stumbling over your words.

Apple wants to cool down your phone. The company wants to patent “temperature-adaptive battery charging” so your phone doesn’t overheat when you’re charging on hot summer days.

What else is new?

Apple’s Mac shipments tumbled more than 40% in the first quarter of 2023, the largest decline among rivals like Dell, HP and Lenovo amid contraction of consumer demand.

Tesla is opening a Megafactory in Shanghai capable of producing 10,000 megapacks annually, aiming to supplement output from a factory in California.

Is your portfolio prepared to weather a recession? Those with a penchant for history understand that all bets are off for equities when the recession bells toll. An alternative in any economic scenario is an investment in the asset responsible for our much-needed food supply. With AcreTrader, you can invest in parcels of farmland across our nation, which have historically acted as a natural inflation hedge and portfolio diversifier. Start investing in farmland with AcreTrader.*

Have any comments, tips or suggestions? Drop us a line! Email at admin@patentdrop.xyz or shoot us a DM on Twitter @patentdrop.

Disclaimer: *AcreTrader Financial, LLC member FINRA|SIPC

Alternative investing involves a high degree of risk, including complete loss of principal and is not suitable for all investors. Past performance does not guarantee future results and there is no guarantee this trend will continue. Sources *(n.d.). Annual Historical Farmland Returns. NCREIF Farmland Index. You cannot directly invest in an index. Does not represent results of a real investment.