Special Report: Meta’s Many Changes

In the 20 years since Facebook was first formed, Meta has morphed into something far larger than a simple social media platform.

Sign up to uncover the latest in emerging technology.

What started out in 2004 as a simple platform to connect with friends online has turned Facebook (now Meta) into one of the biggest tech firms on the planet, pursuing multi-faceted business ventures including the metaverse, AI and even a brief stint in blockchain.

The company’s patent history is littered with inventions all over the tech spectrum. Just in the past year, Patent Drop has dug into a handful of these applications, including tech like in-ear brain wave readers, its own version of a smartwatch and methods to farm synthetic data. The range of these filings seemingly reveal Meta’s strategy: It wants to be versatile.

“One of the greatest characteristics of Meta is adaptability,” said Mayuranki De, research analyst covering the digital economy sector at Global X ETFs.

While the company sinks billions into its metaverse and AI efforts, it has always relied on digital advertising as its gold mine. The company brought in nearly $132 billion in digital ad revenue in 2023, up 16% from $113 billion the year before. Ads made up 97% of the company’s total revenue of nearly $135 billion for the year.

“Meta’s core functionality, in my view, has always been this massive user base that they have,” said De. “It all comes down to their user base … because that is where their monetization comes from.” Because of this reality, a lot of its tech development and innovation serves to feed the digital ad machine.

Into the Metaverse

Its most significant pivot was its rebranding to Meta Platforms in late 2021. Though the company had been working in the virtual reality space since it acquired Oculus labs in 2014, it wasn’t until 2022 that it made a massive public commitment to the concept of the metaverse.

Its patents in this realm look to claim innovations on both the hardware and the software side, often looking at ways to make interacting with the metaverse more seamless. For example, its patent to read and interpret your body’s neural and muscular signals could allow for more control of virtual worlds without the bulk of handheld controllers. Meanwhile, its patents for cleaner foveated rendering and gaze tracking could make mixed reality experiences less of an eyesore (literally).

Meta’s objective with these devices is simple: to get them into as many hands as possible, said D.J. Smith, co-founder and chief creative officer at The Glimpse Group. And making mixed reality a comfortable experience is the way to do it. “Their whole goal is building that community — and building it at ground zero so that they own that community going forward,” said Smith.

Like the rest of the tech industry, Meta has shifted a lot of its attention from the metaverse to AI. But it certainly hasn’t shelved these ambitions, releasing its latest mixed reality headset, the Meta Quest 3, and a set of smart glasses in partnership with Ray-Ban in October. Much of the company’s future slate will consist of AR devices, rather than VR, The Verge reported in March.

And while the recent release of the Apple Vision Pro created another competitor, the Quest 3 may also spur more interest in the mixed reality market as a whole, De noted. “I think in a way you can even see it as healthy competition,” she said. “AR/VR headsets are a space that wasn’t getting as much attention for a year or so, but with this … massive bet that (Apple) is putting in the space, it actually can be a positive for companies like Meta.”

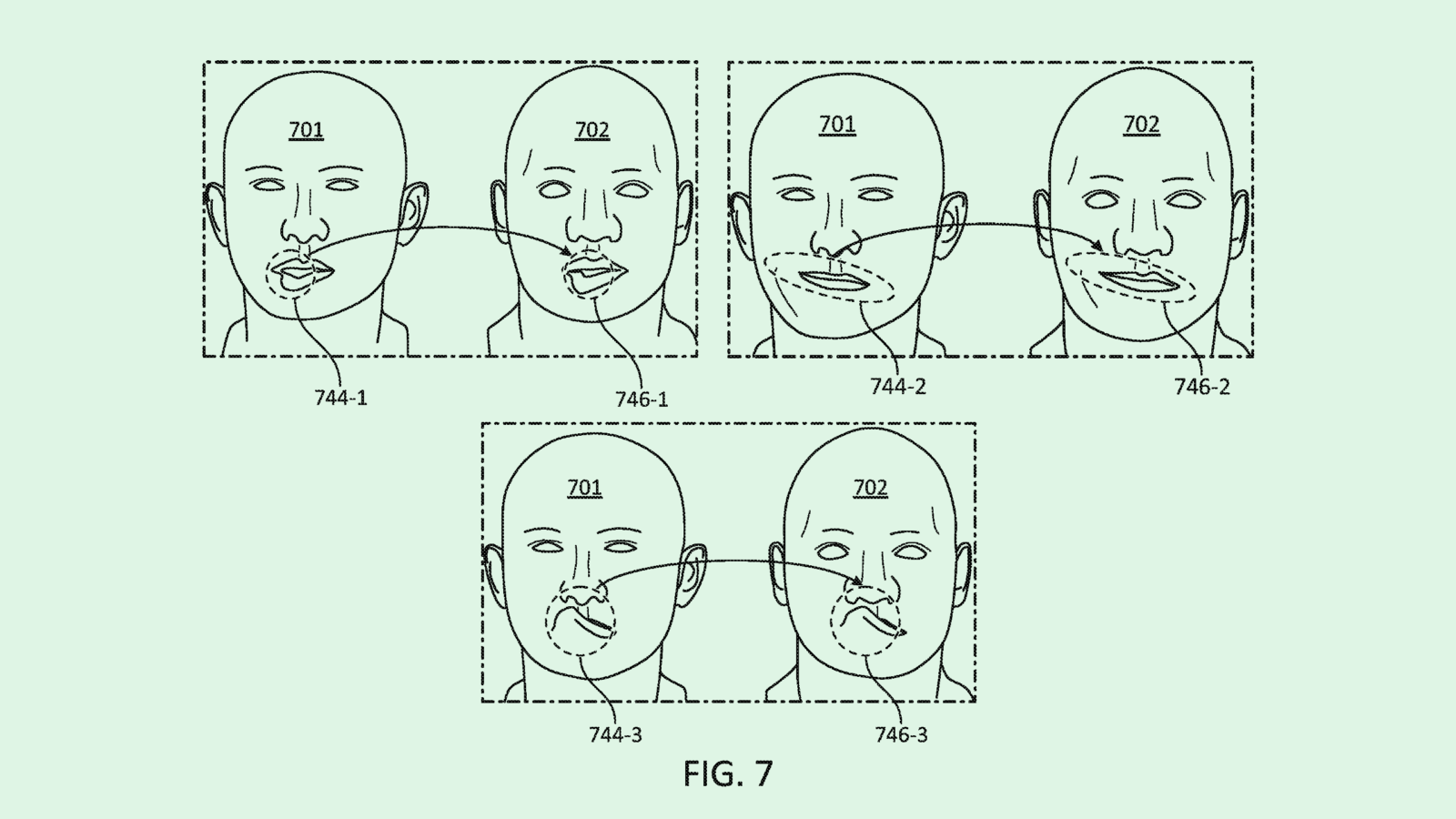

Meta’s AI development is also likely to coalesce with its metaverse work, said Smith, particularly as a helpful tool for developers. It’s already started working on ways this may work: Its patent for “AI curation and customization” of extended reality environments uses generative AI to automatically create digital objects, and its filing for “expression transfer to stylized avatars” uses neural networks to recreate your face.

But creating this tech has been expensive. Reality Labs, the business unit in charge of bringing the metaverse to life, lost $16.1 billion in 2023, up significantly from the $13.7 billion the unit lost in 2022. Meta said in its earnings report on Thursday that it expects losses for Reality Labs to “increase meaningfully year-over-year due to our ongoing product development efforts in augmented reality/virtual reality and our investments to further scale our ecosystem.”

Though the company has yet to turn a profit in the metaverse, hardware isn’t likely to be its moneymaker, said Smith. The company is already looking into ways to track user engagement in virtual reality, likely as a means to track ad performance. Once adoption reaches a certain point, Smith noted, he expects the company to “take what it has mastered on (social media) and apply that same business and bring it over into the immersive experience side of things,” he said. “Once they have those communities, then they can apply the revenue model to it.”

Plus, after losing $10 billion in ad revenue from Apple’s 2021 iOS change that limited apps’ capability to track user behavior, owning its own AR/VR operating system could also help it be less beholden to changes of other ones, said Derek Higa, research analyst and director at William O’Neil. “A significant reason for Meta to venture into VR/AR is to own this platform and not be vulnerable to these risks in the future,” he said.

Joining the AI race

Amid the company’s self-titled “year of efficiency,” AI has become a primary focus. After the initial hype following ChatGPT’s release by OpenAI, Meta dropped its own large language model, LLaMa, last February, followed by a second generation in July and a code-specific model called Code LLaMa in August. Last week, the company released Code LLaMa 70B, which it calls its “largest and best-performing model” yet. On the hardware side, Meta is reportedly working on its own custom AI chips.

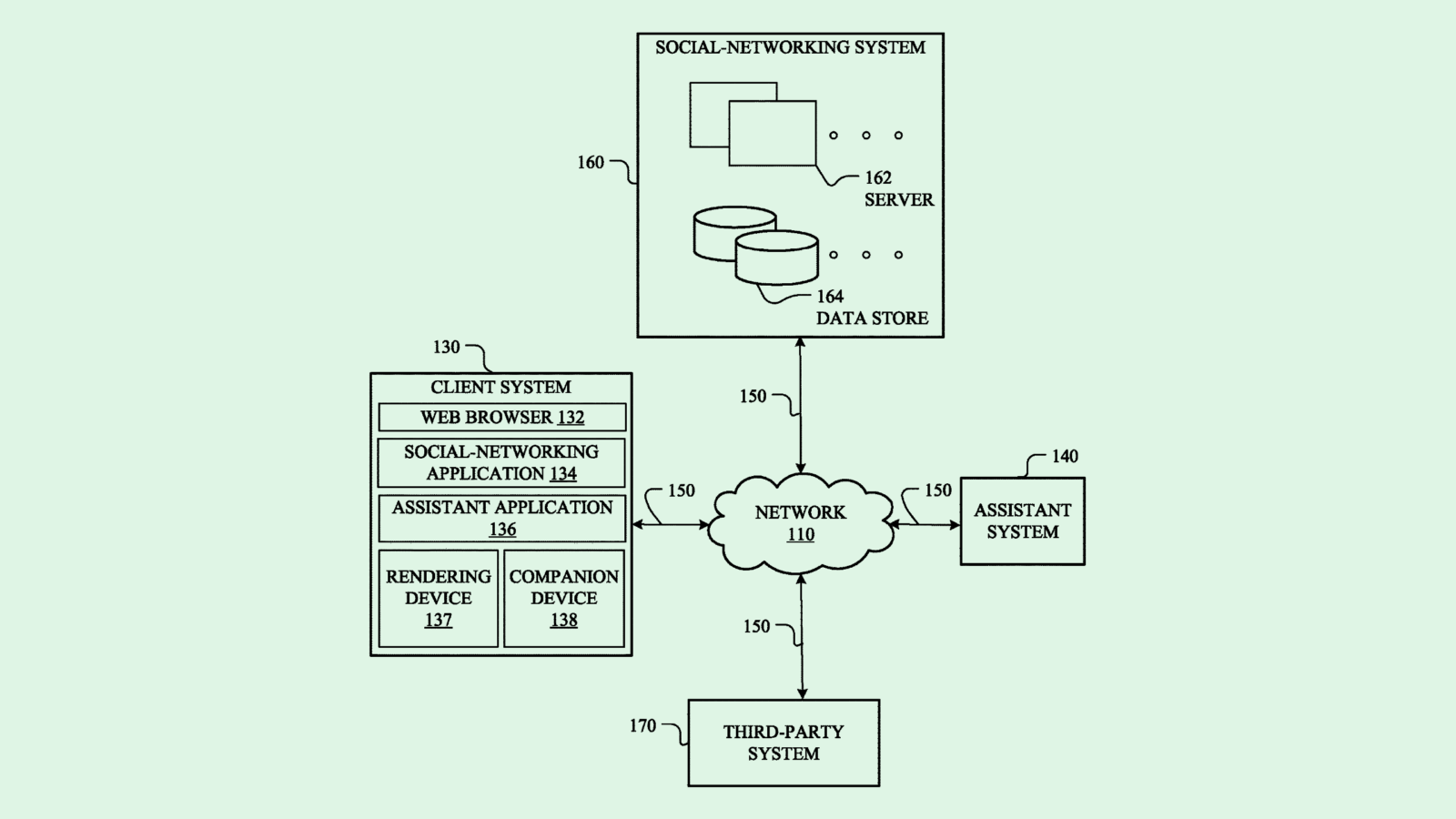

The company’s social platforms have gotten their own AI integrations, including chatbots that mimic celebrity personalities such as Kendall Jenner and Tom Brady, AI-customizable stickers and an AI personal assistant. Its patent filings detail a few more consumer-focused AI plans, including a generative image model that considers “content appropriateness” and a multi-modal chatbot that works with user-specific data.

And since one of AI’s key functions is pattern recognition and prediction, it can be a particularly helpful tool in tracking user behavior. With that capability, Meta has researched ways to predict how well content will perform and determine user intent on a social platform.

AI development also doesn’t come cheap. Meta said on Thursday that it expects its capital expenditures for 2024 to land between $30 billion and $37 billion, up from $28 billion in 2023, driven by “ambitious long-term AI research and product development efforts.”

While Meta has stiff competition in the development of general models like ChatGPT or Google’s Bard, it will likely see more success in creating consumer-facing AI than other tech firms, said Bob Rogers, PhD, data scientist and CEO of Oii.ai. One project in particular that it stands to benefit from, Rogers said, is Cicero, an AI developed by Meta in 2022 that can play the complex strategy game of Diplomacy.

This model, which achieved breakthroughs both in natural language processing and AI strategic reasoning, could have greater implications than just playing a game online, said Rogers: “The idea of creating AI that can plan a strategy to influence the behavior of people is actually quite fascinating. Rather than just building generic language models, building these tools that really define strategies for influencing behavior, I think that’s a big advance.”

Meta’s access to a dragon’s hoard of consumer data — specifically data of different varieties that’s rich in context — could give it a unique advantage in developing AI systems that are “very different from what other groups are doing,” said Rogers. CEO Mark Zuckerberg seems aware of this advantage too, saying on the company’s earnings call that Meta has access to “hundreds of billions of publicly shared images and tens of billions of public videos, which we estimate is greater than the common crawl data set.”

One of the company’s patents reveals that it’s researching ways to create synthetic data from the “data patterns” of authentic user information. But Meta doesn’t have the best history with handling user data (remember the Cambridge Analytica scandal?) and reportedly disbanded its responsible AI team in November, which was responsible for making sure AI development happened in an ethical way.

Plus, security risks inherently exist with AI models themselves, Rogers added. “It’s very easy to try to pull information out of a trained model,” he said. “If those models have been trained on people’s data … There are probably ways to ask the model questions and have it expose private data. That is something that’s very hard to prevent without explicit tooling sitting on top of it.”